Ideally, kids grow up to make good money decisions, working with funds without relying on anyone else. Getting them to this point takes work,  however. These methods can lay a solid foundation for your kids’ financial independence.

however. These methods can lay a solid foundation for your kids’ financial independence.

1) Make your money tasks a routine part of your schedule.

Kids are masters of imitation. Whatever you do, they likely will copy. Set up a time at least once a week where they see you paying your debts, shopping for necessities (preferably with a list) and working on your budget. Approaching financial tasks with consistency in this way helps kids accept that money management is doable, normal and a regular responsibility, just like brushing their teeth or getting homework done.

2) Give them responsibility over a portion of your budget.

Like adults, kids learn really well through experience—that is, they often achieve high success if they can complete tasks themselves hands on. Kids also tend to pay more attention to money if they have some degree of direct control over it. Letting your kids handle a small portion of the budget—this can mean they’re responsible for just tracking funds if younger or doing complete planning if older—makes them feel empowered, all while creating good financial transparency between you and them that fosters trust.

3) Insist they wait a day to buy.

Kids are still developing impulse control and are still quite emotionally driven in their purchase decisions. A wait-one-day rule forces them to get past the initial feelings of gotta-have-it-now and really think about whether the planned transaction is worth it. Getting a handle on purchase impulse will become critical as an adult when the habit of buying in the moment (particularly on credit) can spell big debt disaster. You can change the day to a week or even a month if items are particularly pricey, but the basic concept that time won’t derail serious intent holds.

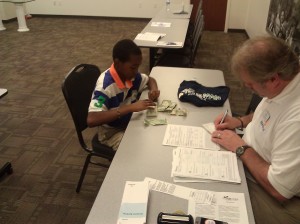

4) Let them spend.

Saving money is always laudable, but ultimately, it’s designed to be spent at some point. Different types of transactions—for example, an online purchase versus a garage sale buys—all have different processes and expectations associated with them, which your kids can learn only if they go through each type of task. Not only that, but spending can teach valuable lessons about quality. They might make a mistake and buy a cheap toy at a dollar store that breaks, for example, but they’ll learn from the experience not to purchase that item anymore. They also get a boost from knowing you trust them to follow through and make good choices with what they have, and they need the opportunity to prioritize which purchases are most important.

5) Have them create savings goals.

Part of being financially independent involves having a game plan. Without one, it’s impossible to tell if you’re on track with your money, and overspending becomes easy. Even small savings goals, teach kids to have a more long-term view of their funds, curbing impulse. Goals also tie in with basic budgeting, such as setting aside $20 every month to be able to buy a laptop. When your kids reach the goals they have set, they can feel good about what they’ve accomplished.

6) Let them open a savings or checking account.

Savings and checking accounts both are great for kids because they expose children to the basics of banking, such as how to make a deposit. They create a secure place for  kids to keep their money, as well, all while (generally) providing the opportunity to earn some interest. There is also convenient to consider, such as the ability to use a debit card to buy something online.

kids to keep their money, as well, all while (generally) providing the opportunity to earn some interest. There is also convenient to consider, such as the ability to use a debit card to buy something online.

7) Tell stories about entrepreneurs.

Money security doesn’t just come from meticulous spreadsheets or buying things on sale all the time. It also comes from being able to see what’s possible and taking some risks with investments, which entrepreneurs do better than anyone. Share stories about entrepreneurs so your kids know it’s okay to think outside the box financially and are inspired to come up with new, creative ways to earn or manage funds.

Conclusion

The simple reality is that, eventually, you’re not going to be around your kids 24/7. They’ll need to be comfortable working independently with money before they venture out on their own. These basic strategies can help them get there.